Decision Time

February 9, 2023

High school, the final four years as a kid before students take their first big step out in the world and become an adult.

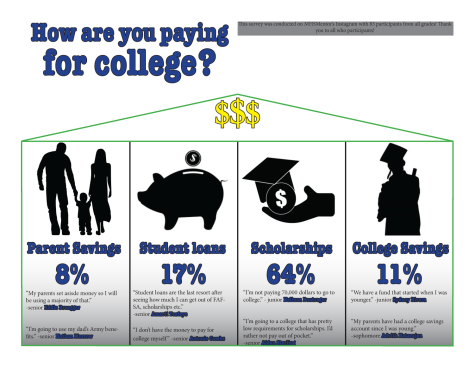

For some, that’s where their education ends, but for others, that’s where the real learning starts. College is the thing most high school students’ minds are at, with thinking about where to attend to be educated, what to major in and how to pay. Now-a-days the hardest part of that process is the payment. There are a few ways for students to pay for college. They can have their parents pay, get a lot of scholarships, have college savings or apply for a student loan that leaves them in debt.

With these options in place students must find the choice that helps them the most out, financially.

“For me, I had to get in for soccer,” senior Taylor McHugh said. “For the most part I have a couple of scholarships but I’m trying to find a little more.”

Getting scholarships is one of the most important decisions a student can make. Students will have to apply for scholarships through the colleges of their choice or foundations devoted to help students pay for college. It’s best to talk to grade level counselors so they can help students make the best choices. McHugh is attending Colorado State University in Pueblo, with in-state tuition being $9,005 and out-of-state tuition being $15,659 per year for undergraduate education.

Scholarships come in a lot of different forms, the most prominent being academic and athletics but getting these scholarships force students to enroll differently than their peers.

“Because of soccer I had to verbally commit a little earlier to get the scholarship,” McHugh said. “I had to commit much earlier.”

Some students don’t have the opportunity to get sports scholarships like McHugh. Senior Lesley Sullivan, who was accepted into the University of Kansas, is expecting tuition of $11,166 in-state annually.

“We submitted our [Free Application for Federal Student Aid, or FAFSA],” Sullivan said. “But I did get a small scholarship as well.”

Sullivan is planning to major in business analytics while she attends KU. Sullivan submitted her FAFSA hoping to be eligible for federal grants, work-study or loans to contribute to paying students tuition, and in some cases it reduces tuition cost.

Since McHugh and Sullivan both plan on attending college out of Manhattan they each have their own fears about being away from home.

“One of my fears is being in a new town,” Sullivan said.

To help with these fears there are First Year Students and Student Success Programs that can help students adapt to the new environments of colleges.

Some Manhattan High students aren’t too sure about college, like junior Elijah Cunningham.

“I don’t know where I want to go to college,” Cunningham said. “I’ve only looked at a few colleges in the state of Kansas.”

Even though Cunningham is a year off from college he also has his own fears.

“It really freaks me out just realizing I’m about to be a responsible adult,” Cunningham said. “It’s crazy to think about.”

The pandemic hit and everything got messed up, but the pandemic is over and colleges are looking for people who are involved in school activities.

“We want a graduate who’s well-rounded,” said Roger Schieferecke, Assistant Dean and Director of the Kansas State University College of Education. “Club organizations show leadership and work in a community.”

Students being involved is important not only for college but for finding their own interests. For example, Sullivan is the president of the Thespians Troupe and Cunningham is involved in band and Games Club. You can also get scholarships for participating in these activities like McHugh and her soccer scholarship. It’s important that students start planning for their futures in college by using the resources they are given.

“You at Manhattan High school, wherever you go you have the ability to change the world one interaction at a time,” Schieferecke said.